Your Guide to How To Fill Out 1040

What You Get:

Free Guide

Free, helpful information about 1040 FAQ and related How To Fill Out 1040 topics.

Helpful Information

Get clear and easy-to-understand details about How To Fill Out 1040 topics and resources.

Personalized Offers

Answer a few optional questions to receive offers or information related to 1040 FAQ. The survey is optional and not required to access your free guide.

Navigating the 1040 Form: Your Complete Guide to Filing with Confidence

Filing taxes can be a daunting task, especially when faced with the infamous IRS Form 1040. It's the cornerstone of individual tax returns in the United States, and understanding its intricacies is crucial for an accurate submission. Whether you're a first-time filer or just need a refresher, this guide will demystify the process, offering clarity and confidence as you tackle your tax responsibilities.

📂 Understanding Form 1040: What Is It and Why It Matters

At its core, Form 1040 is the U.S. Individual Income Tax Return. It acts as the primary document used to report your yearly income and calculate how much you owe in taxes or how much of a refund you'll receive.

Key Components of Form 1040

- Personal Information: Includes name, Social Security Number, and filing status.

- Income Section: Here, you'll report wages, salaries, dividends, and other earnings.

- Deductions and Credits: This part enables you to apply for tax reductions through eligible deductions and credits.

- Tax and Payments: This section calculates how much tax is owed after deductions and credits, and shows previous payments made.

- Refund or Amount Owed: Determines the refund you'll receive or the amount still owed to the IRS.

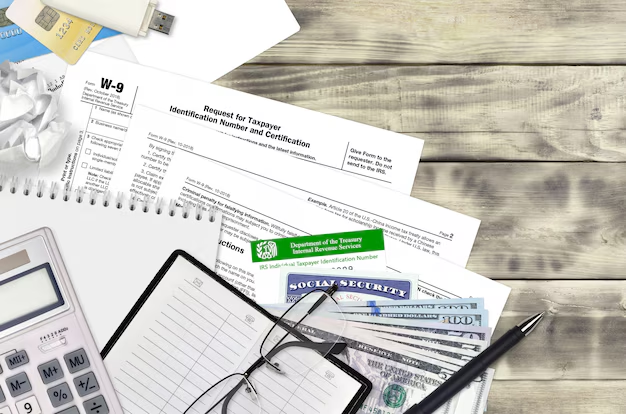

📒 Preparing to Fill Out Form 1040

Before you start, gather all necessary documentation to ensure a smooth process. Preparation minimizes errors and expedites your filing.

Essential Documents to Have

- W-2 Forms: From each employer you worked for in the tax year.

- 1099 Forms: For additional income such as freelancing, investments, or social security benefits.

- Receipts for Deductions: Documentation for deductible expenses, like charitable donations and mortgage interest.

- Past Tax Returns: Previous filings can help guide you through potential deductions and credits.

Choosing the Right Filing Status

Selecting the correct filing status is essential as it affects your tax rate and eligibility for certain credits. The basic options include:

- Single: For individuals not married at the end of the tax year.

- Married Filing Jointly: A common choice for couples to benefit from joint tax benefits.

- Married Filing Separately: Considered when each spouse wants to be responsible for their own tax.

- Head of Household: Available for unmarried individuals who pay over half the cost of keeping up a home for themselves and a qualifying person.

- Qualifying Widow(er): For those who have lost a spouse and have a dependent child.

📝 Step-by-Step Guide to Completing Form 1040

Filling out Form 1040 requires careful attention to detail. Here's a simple breakdown to ease your process:

1. Start with Personal Information

Enter your full name, Social Security Number, and filing status. Ensure this information matches what the IRS has on file to avoid processing issues.

2. Report Your Income

In this section, you’ll compile all sources of income:

- Line 1: Wages, salaries, and tips.

- Line 2: Interest income—reported to you on Form 1099-INT.

- Line 3: Dividend income—typically from Form 1099-DIV.

- Line 4: IRA distributions and pensions.

- Line 7: Capital gains from the sale of assets.

3. Understand and Claim Deductions

Deductions can lower your taxable income. Standard deduction vs. itemized deduction are the two approaches:

- Standard Deduction: A fixed dollar amount based on your filing status.

- Itemized Deductions: Detailed write-offs, such as medical expenses over 7.5% of AGI, state taxes, and charitable contributions.

4. Explore Credits

Tax credits offer direct reductions in taxes owed and can be more beneficial than deductions.

- Child Tax Credit: For each qualifying dependent child.

- Education Credits: Including the American Opportunity Credit and Lifetime Learning Credit for post-secondary education expenses.

- Earned Income Credit (EIC): Aimed at low-to-moderate-income working individuals and families.

5. Calculate Your Tax

Utilize the IRS tax tables or online calculators to determine how much tax you owe based on your taxable income minus any credits.

6. Determine Your Payments or Refund

Here, assess previous tax payments made through withholdings or quarterly tax payments. If total payments exceed your calculated tax, claim a refund.

🧾 Common Mistakes to Avoid

Filing mistakes can lead to delays or penalties. Stay vigilant to prevent these common errors:

- Incorrect Social Security Numbers: Double-check for accuracy.

- Mistyped Math Calculations: Use a calculator or tax software to ensure correct arithmetic.

- Missed Signatures: Unsigned forms can stall processing.

- Wrong Filing Status: Ensure your filing status reflects your situation for appropriate benefits.

🛠 Tips for Streamlining the Process

Making the tax filing experience smoother comes down to preparation and utilizing available resources:

- Consider Tax Software: Many software platforms guide you through the tax return process for added accuracy.

- Hire a Professional: If your tax situation is complex, an accountant can offer tailored guidance.

- File Electronically: E-filing through the IRS offers faster processing and reduces errors.

📊 Quick Reference Summary

Here's a quick-look chart to keep you on track while filling out your Form 1040:

| Section | Key Actions | Common Pitfalls to Avoid |

|---|---|---|

| Personal Info 🏷️ | Enter accurate personal and status information | Incorrect SSN or filing status |

| Income Section 💰 | Report all income sources accurately | Forgetting 1099 income forms |

| Deductions ✂️ | Decide between standard or itemized deductions | Overlooking possible deductions |

| Tax Credits 🎁 | Claim eligible credits to reduce owed taxes | Missing out on applicable credits |

| Tax Calculation 📈 | Use tax tables to figure taxes owed after credits | Miscalculations |

| Payments/Refund 💵 | Ensure prior payments are accurate | Incorrect refund information |

| Filing Tips & Tricks 🧩 | Consider software or professional help, file electronically | Late filing penalties and errors |

Staying Informed for Future Filings

Keeping abreast of tax law changes helps ensure future filings are as accurate and advantageous as possible. Workshops, IRS updates, and annual tax news provide valuable insights into evolving tax regulations.

In summary, while Form 1040 may seem daunting at first glance, understanding its structure and gathering the right information can turn the task from stressful to manageable. Being thorough, leveraging available resources, and maintaining organization are the keystones to a successful tax season. By following this guide, you're better equipped to handle your tax responsibilities with confidence and ease.

What You Get:

Free 1040 FAQ Guide

Free, helpful information about How To Fill Out 1040 and related resources.

Helpful Information

Get clear, easy-to-understand details about How To Fill Out 1040 topics.

Optional Personalized Offers

Answer a few optional questions to see offers or information related to 1040 FAQ. Participation is not required to get your free guide.